Embark on a rewarding journey with this Investment Guide to Spanish property, where insight and expertise light the way to success! As experts, in the Estepona Real Estate Market we would like to give you some insights on navigating the Spanish real estate scene with ease and confidence.

Imagine a place where every day feels like a holiday—welcome to the Costa del Sol! This sun-kissed coast has transformed from a simple getaway spot to a vibrant hub for investors and expats from all corners of the globe. With its stunning beaches, lively cities, and a lifestyle that’s second to none, the Costa del Sol is buzzing with opportunities. Whether you’re drawn to the cultural vibrancy of Malaga or the chic allure of Marbella, this region is ripe with potential, thanks to a perfect blend of cultural richness, economic growth, and a diverse community. Come explore with us and find your own slice of paradise! 🌞🏡

Maximizing Returns: Proven Investment Principles

The Off-Plan Investment Guide: Building Your Future in Spain

The allure of owning a property in Spain has always been strong among investors, and off-plan investments offer a unique opportunity in the real estate market. Off-plan properties are those that are purchased before they are built, providing investors with the potential for significant savings and customization options.

Understanding Off-Plan Investments

Off-plan property investments involve purchasing a property directly from a developer before construction has been completed. This type of investment can be particularly attractive in Spain, where the real estate market has seen a resurgence in recent years. Investors are drawn to off-plan properties for several reasons, including the possibility of buying at a lower price compared to the finished product, the option to customize features and finishes, and the potential for capital appreciation during the construction phase.

The Process and Benefits

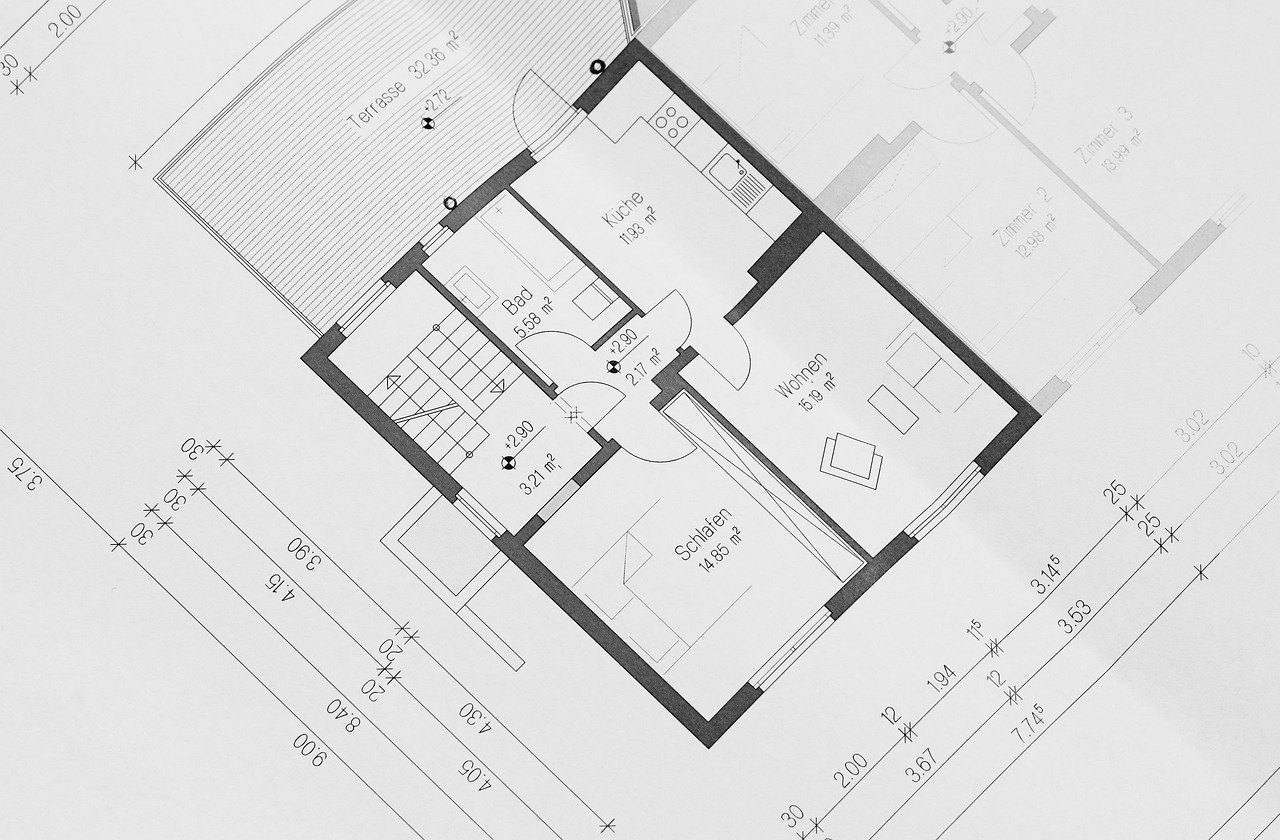

When investing in an off-plan property in Spain, the process typically begins with the selection of a property based on architectural plans and development specifications. A deposit is then paid to secure the property, followed by stage payments throughout the construction period. One of the key benefits of off-plan investments is the ability to lock in a purchase price at the current market value, which could be significantly lower than the value of the completed property, especially in high-demand areas.

Risks and Considerations

While off-plan investments can be lucrative, they are not without risks. Delays in construction, changes in market conditions, and potential legal issues are factors that investors must consider. It is crucial to conduct thorough due diligence, including verifying the developer's track record, ensuring all necessary permits are in place, and obtaining a bank guarantee for deposits made. Consulting with a reputable real estate lawyer can provide additional security and peace of mind.

The Spanish Market Outlook

The Spanish property market has shown resilience and growth, making it an attractive destination for off-plan investments. Areas such as the Costa del Sol and major cities like Madrid and Barcelona continue to be hotspots for development. With a favorable climate, rich culture, and strong tourism industry, Spain remains a top choice for investors looking to capitalize on off-plan property opportunities.

Off-plan property investments in Spain offer a strategic avenue for those looking to enter the real estate market. With careful planning, due diligence, and professional guidance, investors can navigate the complexities of off-plan purchases and potentially reap the rewards of their investment. As with any investment, it is essential to weigh the benefits against the risks and make informed decisions based on current market trends and personal financial goals.

Property Flipping: A Strategic Approach to Real Estate Investment

Property flipping, also known as house flipping, is a real estate investment strategy that has gained significant traction over the years. This approach involves purchasing properties, often those in need of repair or renovation, and then selling them at a higher price for a profit. The concept is simple: buy low, sell high, and do it quickly.

The Origins and Evolution of Property Flipping

The origins of property flipping can be traced back to the early days of real estate trading, where investors sought to capitalize on market inefficiencies. However, it wasn't until the late 20th century that flipping became a popularized investment strategy, particularly in the United States. The practice gained widespread attention during the housing boom of the early 2000s, where many investors saw substantial returns on their flipped properties.

In recent years, property flipping has become a global phenomenon, with various television shows and online content dedicated to the art of transforming rundown properties into desirable homes. The trend has also caught on in Spain, where investors are turning to flipping as a way to navigate the country's challenging macroeconomic environment.

The Process of Property Flipping

The process of property flipping typically involves several key steps:

- Market Research: Successful flippers start with thorough market research to identify undervalued properties in promising locations.

- Acquisition: The next step is to acquire a property at a price point that allows room for renovation costs and potential profit.

- Renovation: Flippers then make strategic improvements to the property to enhance its value and appeal to buyers.

- Sale: Once the renovations are complete, the property is put back on the market and sold at a higher price.

Benefits and Challenges

One of the primary benefits of property flipping is the potential for high returns on investment. By improving the property and selling it in a short timeframe, investors can realize profits that might take years to achieve through traditional rental income.

However, flipping is not without its challenges. It requires a keen eye for potential, an understanding of renovation costs, and the ability to navigate the real estate market effectively. Additionally, flippers must be prepared to handle the risks associated with market fluctuations and the possibility of unexpected renovation issues.

Property flipping is a dynamic and potentially lucrative form of real estate investment. It offers the excitement of transforming properties and the satisfaction of turning a profit. For those willing to do their homework and take on the inherent risks, flipping can be a rewarding venture. As with any investment strategy, success in property flipping comes down to education, experience, and a bit of entrepreneurial spirit. For more insights into the world of property flipping, consider exploring further resources and guides available online.

Property Renovation Projects: Unveiling Value in Spanish Real Estate

The allure of property renovation in Spain is undeniable. With its rich history, diverse landscapes, and vibrant culture, Spain offers a plethora of opportunities for those looking to breathe new life into old structures. From rustic fincas in the countryside to historic townhouses in bustling cities, the potential for transformation is vast and varied.

Renovation projects in Spain are not just about the aesthetic enhancement of properties; they're about reviving the essence of spaces that have stood the test of time. These projects can range from simple cosmetic upgrades to complete structural overhauls. The common thread, however, is the vision to create something beautiful, functional, and valuable from what was once overlooked or neglected.

For the intrepid investor or the dreamy homeowner, embarking on a renovation project in Spain is a journey of discovery. It's an opportunity to uncover hidden architectural gems, to preserve cultural heritage, and to contribute to the local economy. But it's not a path for the faint-hearted. Renovation requires dedication, patience, and a willingness to navigate the complexities of construction, legalities, and design.

The market for renovation properties in Spain is rich with possibilities. In regions like Andalucía, properties that require a touch of care are abundant, offering a chance to own a piece of Spanish charm at a fraction of the cost of a turnkey home. These projects can be as rewarding financially as they are personally, with the potential for significant returns on investment once the renovation is complete.

However, it's crucial to approach these projects with a strategic mindset. Prospective renovators must consider the location, the extent of the required work, and the end goal of the renovation. Is it to sell at a profit, to rent out, or to enjoy as a personal residence? Each objective demands a different approach and set of considerations.

A successful renovation project begins with thorough research and planning. Understanding the local property market, identifying the right property, and assembling a skilled team of professionals are the first steps toward a successful transformation. Architects, builders, and legal advisors with experience in renovation can provide invaluable insights and guidance throughout the process.

Budgeting is another critical aspect. Renovations can be unpredictable, and costs can escalate quickly. A detailed budget, including a contingency for unforeseen expenses, is essential. Additionally, navigating the legal landscape of property renovation in Spain requires attention to detail. Securing the necessary permits and ensuring compliance with local regulations are non-negotiable steps in the renovation journey.

The rewards of property renovation in Spain are manifold. Beyond the financial gains, there's the satisfaction of contributing to the preservation of Spanish architecture and the joy of creating a space that reflects one's personal taste and style. For those with the vision and the fortitude, the Spanish property renovation market is ripe with opportunity.

Remember, the key to a successful renovation is in the planning, so take the time to envision, research, and prepare for the journey ahead.

From Purchase to Profit: The Buy-to-Let Investment Cycle

The allure of buy-to-let investments continues to captivate the interest of potential landlords and investors worldwide. This investment strategy involves purchasing a property with the intention of renting it out to tenants, thereby generating a steady stream of rental income. It's a tangible asset that can potentially appreciate over time, offering both short-term income and long-term capital growth.

Understanding the Market Dynamics

Before diving into buy-to-let investments, it's crucial to understand the market dynamics. The property market is cyclical, with periods of rapid growth, stability, and decline. Investors should adopt a long-term perspective, recognizing that property values don't always increase and rental demand can fluctuate based on various economic factors.

Legal Considerations and Tax Implications

In Spain, for instance, the legal framework and tax implications for buy-to-let investors differ based on residency status. Non-residents may face more challenges in obtaining mortgages and are subject to specific tax regulations on rental income. Conversely, residents can benefit from tax credits and deductions, making the investment more appealing.

The Importance of Due Diligence

Due diligence is paramount when considering a buy-to-let investment. Prospective landlords should thoroughly research the property's location, potential rental yield, and associated costs, such as maintenance, management fees, and taxes. Legal advice is also advisable to navigate the complexities of property ownership and rental regulations.

Financing Your Investment

Most buy-to-let investors will require a mortgage to finance their purchase. Buy-to-let mortgages are designed for this purpose, with the rental income typically covering the mortgage repayments. However, investors must consider additional expenses and ensure they have a buffer to cover periods when the property may be vacant.

Buy-to-let investments can be a lucrative venture for those willing to commit to the responsibilities of being a landlord and who are prepared for the long-term nature of property investment. With careful planning, market research, and professional advice, investors can navigate the challenges and capitalize on the opportunities presented by the buy-to-let market. As with any investment, it's essential to weigh the potential risks against the expected returns and proceed with a well-informed strategy. For more detailed insights and guidance, consider exploring comprehensive guides and seeking expert consultation.

Property Partners: Crafting Equity Alliances for Growth

In the dynamic world of real estate investment, Property Equity Partnerships (PEPs) have emerged as a significant force, enabling investors to pool resources and expertise to acquire and manage properties that would be beyond their individual capabilities. These partnerships can take various forms, but most commonly involve a General Partner (GP) who manages the investment and Limited Partners (LPs) who provide the capital.

The essence of a PEP lies in its structure, which is designed to align the interests of all parties involved. The GP, often a real estate professional or firm with substantial market knowledge, takes on the responsibility of managing the day-to-day operations of the property. This includes tasks such as acquisition, maintenance, tenant relations, and eventually, the sale of the property. In return for their expertise and management, GPs typically receive a management fee, as well as a share of the profits generated by the property.

On the other side, LPs are usually passive investors who contribute the majority of the equity needed to finance the property's purchase. These investors may range from high-net-worth individuals to institutional investors such as pension funds or private equity firms. LPs benefit from the potential for high returns on their investment without the burden of managing the property. They also enjoy limited liability, meaning their risk is restricted to the amount of their investment in the partnership.

The advantages of PEPs are manifold. They allow for the sharing of risk and reward among investors, provide access to larger and potentially more lucrative investment opportunities, and offer the possibility of portfolio diversification. Moreover, the pass-through tax treatment of these partnerships ensures that profits are taxed only once, at the individual partner level, avoiding the double taxation that corporations face.

However, potential investors should be aware of the complexities and risks involved. The success of a PEP hinges on the GP's ability to effectively manage the property and navigate the real estate market. Additionally, the illiquid nature of real estate investments means that partners may need to commit their capital for an extended period before realizing returns.

In conclusion, Property Equity Partnerships represent a collaborative approach to real estate investment, one that leverages collective resources for mutual benefit. For those considering such an investment, it is crucial to conduct thorough due diligence, understand the partnership agreement's terms, and assess the track record and expertise of the GP. With careful consideration and the right partners, PEPs can be a valuable addition to an investor's portfolio.

Spanish Property Law Decoded: A Comprehensive Overview

Spain's property laws and regulations are a complex web of national and regional legislation, designed to ensure a robust legal framework for property ownership and transactions. The country has been making strides in improving its regulatory environment, particularly in the realm of property law.

The Spanish property market is governed by a variety of laws and regulations that aim to protect both buyers and sellers. The main legislative body governing these laws is the Companies Law, approved by Royal Legislative Decree 1/2010, which covers a wide range of issues relevant to property transactions, including legal duties, liability regimes, and shareholders' rights.

In recent years, Spain has taken significant steps to enhance its regulatory policy and governance. The creation of the Regulatory Coordination and Quality Office within the Ministry of the Presidency is a testament to the country's commitment to promoting the quality, coordination, and coherence of rulemaking activity. This office plays a crucial role in overseeing the implementation of Better Regulation requirements, such as Regulatory Impact Assessment (RIA), which is mandatory for all regulations since 2017.

Moreover, Spain has updated its legal framework to align with best practices promoted by the OECD and the EU. The update includes systematic consideration of the impacts of regulatory proposals on competition and Small and Medium-sized Enterprises (SMEs), as well as updated thresholds for the conduct of ex post evaluations.

Transparency and stakeholder engagement are also key components of Spain's regulatory framework. The country has improved the transparency of its system with the introduction of a new centralized online platform that lists all ongoing consultations and allows citizens to engage in normative activity at crucial stages of the policy cycle.

For corporate entities, especially those that are publicly listed, the Companies Law and the Securities Market Law provide a framework for corporate governance. These laws were amended to implement Directive (EU) 2017/828, which encourages long-term shareholder engagement and covers issues such as transparency, disclosure, and tender offers.

Understanding the legal and regulatory frameworks in Spain is essential for anyone looking to invest in or manage property within the country. With its commitment to regulatory improvement and stakeholder engagement, Spain is fostering an environment that is conducive to both domestic and foreign investment in the property sector.

For a more detailed exploration of Spain's property laws and regulations, the OECD's country profile and the Corporate Governance Laws and Regulations report provide comprehensive insights into the current state and recent developments in this area.

“Investment Itinerary: Plotting Your Path in the 2024 Spanish Real Estate Scene

The Spanish real estate market has always been a dynamic and evolving landscape, attracting both domestic and international investors. As we move through 2024, it's essential to understand the current trends and the importance of thorough due diligence in making informed investment decisions.

Market Research Insights for 2024

The year 2024 presents a mixed economic scenario for Spain, with a gradual shift from a slow start to a more dynamic end. The easing of inflationary pressures and the anticipated reduction in interest rates by major central banks are expected to drive the global economy's progress.

In terms of real estate investment, a slight increase in investment volumes is forecasted, following the trend from the last quarter of the previous year. The office leasing sector, which saw few large-scale transactions, holds optimistic expectations for contract signings. Madrid and Barcelona are predicted to maintain historical average absorption levels in the logistics sector. Retail sales are likely to grow above the Eurozone average, albeit at a more moderate pace than in previous years. The investment outlook for the Living sector appears favorable, with Build-to-Rent (BTR) developments, especially affordable products, taking center stage.

The hotel sector anticipates continued growth in reservations and overnight stays, though at a slower rate, with a modest increase in Average Daily Rate (ADR) and Revenue Per Available Room (REVPar). Investors are increasingly incorporating Environmental, Social, and Governance (ESG) considerations throughout the real estate lifecycle. Asset transformation, responding to new ways of working, living, and shopping, is expected to remain a trend in 2024, offering opportunities for reinvention.

The Role of Due Diligence

Due diligence is a critical component of the real estate investment process, providing a comprehensive assessment of a property's legal, technical, and financial aspects. It serves as a preventive measure for legal security and can be a barrier to potential administrative penalties and future litigation between parties.

A meticulous due diligence process includes legal audits to examine property titles and their concordance with the Land Registry, technical-urbanistic audits to assess compliance with building regulations, and tax audits to evaluate fiscal obligations. These audits are tailored to the buyer's profile and the property's intended use, whether for residence or business purposes.

Conclusion

As the Spanish real estate market continues to evolve, investors must stay informed and conduct thorough due diligence to navigate the market successfully. The year 2024 offers both challenges and opportunities, with asset transformation and ESG considerations playing significant roles in investment strategies. By understanding the market dynamics and exercising due diligence, investors can make strategic decisions that align with their goals and the changing landscape of the Spanish real estate market.

For more detailed information on the Spanish Real Estate Market Outlook for 2024, interested parties can consult the comprehensive reports provided by industry experts. Additionally, understanding the due diligence process and its importance in real estate transactions can be further explored through specialized legal resources.

Register today to our Guadalmansa Insider Newsletter and get all the latest updates & news about the Guadalmansa area in your inbox.