Spain Property Tax: Proposed 100% Tax on Non-EU Buyers – Implications and Alternatives

In January 2025, Spanish Prime Minister Pedro Sánchez introduced a proposal to impose a 100% tax on property purchases by non-European Union (EU) non-residents. This initiative, targeting buyers from countries like the United Kingdom, the United States, and China, aims to address the nation’s housing crisis.

While the proposal of Spain Property Tax has sparked widespread debate, its potential impact on foreign investment and property markets remains uncertain. Here’s a closer look at the proposed tax, its challenges, and alternatives for non-EU buyers.

Understanding Spain Property Tax

The proposed tax seeks to levy an additional 100% charge on the purchase price of properties acquired by non-EU non-residents. For example, a non-EU buyer purchasing a property valued at €300,000 would face an additional €300,000 tax, effectively doubling the cost. The primary goal is to deter speculative foreign investments, which are believed to drive up housing prices and reduce affordability for locals.

Who Are the Non-EU Buyers in Spain?

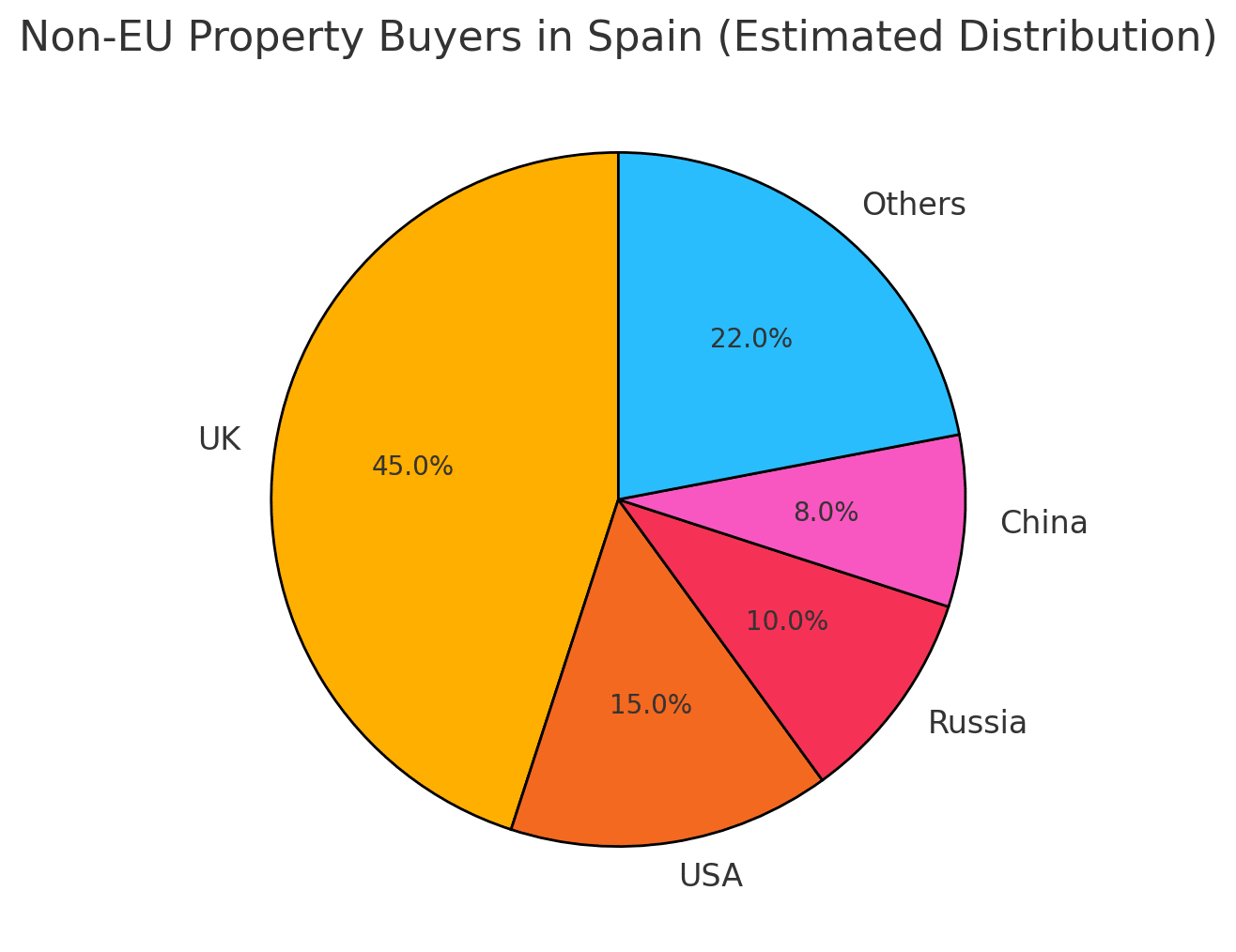

Non-EU buyers represent a substantial segment of Spain’s property market, particularly in high-demand areas such as the Costa del Sol. The estimated breakdown of non-EU property buyers is as follows:

UK: 45% – British buyers are the largest group, drawn to Spain for its climate, affordability, and proximity.

USA: 15% – A growing demographic investing in Spanish real estate for lifestyle and financial returns.

Russia: 10% – Predominantly focused on luxury properties in prime coastal areas.

China: 8% – Driven by stable investment opportunities and long-term value.

Others: 22% – Includes buyers from Canada, the Middle East, and Latin America.

Non-EU buyers accounted for approximately 27,000 property purchases in Spain in 2023, or 4% of all transactions. These buyers are a vital source of demand in the Spanish real estate market.

Potential Consequences of Spain Property Tax

The proposed 100% tax on non-EU property buyers could lead to significant changes in Spain’s real estate market and economy:

- Reduced Foreign Investment: Non-EU buyers, especially from the UK, USA, and China, may be discouraged, impacting sales and construction activity.

- Economic Challenges for Local Areas: Regions dependent on foreign buyers, like the Costa del Sol, could face economic slowdowns affecting businesses tied to real estate.

- Property Price Stabilization: The tax could cool speculative demand, potentially stabilizing or lowering prices in some areas, though prime locations may retain value.

- Harm to Spain’s International Reputation: Spain may lose its appeal as a property investment destination, with buyers shifting to less restrictive markets.

- Market Distortions: Buyers may opt for lower-value properties or explore off-market transactions to avoid the tax.

- Legal and Policy Challenges: The tax’s discriminatory nature may face legal opposition, potentially delaying implementation.

Impact on Non-European Buyers

If the tax is approved, non-EU buyers would face increased costs when purchasing property in Spain, potentially reducing the attractiveness of the Spanish market. However, alternative pathways for residency and investment remain available.

Visa Options for Non-EU Buyers

While the Golden Visa program is ending, non-EU buyers can still explore the following residency options:

1. Non-Lucrative Visa

For individuals with sufficient financial means to reside in Spain without working.

Requirements include proof of income and private health insurance.

2. Digital Nomad Visa

Ideal for remote workers employed by non-Spanish companies.

Requires proof of remote employment and financial stability.

3. Entrepreneur Visa

Designed for those starting innovative businesses in Spain.

Applicants must submit a business plan and demonstrate financial resources.

4. Family Reunification Visa

Allows family members of Spanish residents or citizens to join them in Spain.

Strategic Advice for Non-EU Buyers

Non-EU buyers can adopt several strategies to mitigate the potential impact of the proposed tax:

Focus on Affordable Investments: Target properties with strong rental yields in less-affected regions.

Plan for Additional Costs: Incorporate potential tax implications into your budget.

Seek Residency Options: Explore visa pathways to establish a stable presence in Spain.

Consult Experts: Work with real estate and legal advisors to navigate market challenges.

Our Opinion

The Spanish government currently lacks a clear parliamentary majority, making it difficult to pass controversial laws. Opposition parties and coalition partners may demand amendments or reject the proposal entirely, especially if they perceive it as harmful to the economy.

Critics argue that Spain's new tax could deter foreign investment, which has historically fueled Spain’s real estate, tourism, and construction sectors. Stakeholders in these industries have voiced concerns that such a tax could reduce Spain’s appeal as a global property investment destination.

Real estate developers, agents, and even local municipalities benefiting from property sales taxes have raised concerns about the potential market slowdown. This opposition may further complicate the approval process.

Get Professional Advice

At Livingstone Estates, we are committed to supporting our clients through these changes. Whether you’re buying, selling, or renting property in Estepona or the New Golden Mile, our team offers expert guidance and personalized solutions. Contact us today to explore your options and make informed decisions in this evolving market.

Register today to our Guadalmansa Insider Newsletter and get all the latest updates & news about the Guadalmansa area in your inbox.